The Unified CRM Hub

Fintech · B2B CRM · Data Visualization

01. The Problem

A high-performance CRM ecosystem designed for institutional finance. Financial advisors and consultants operate in a high-stakes environment where data lives in silos.

Before this solution, users toggled between disconnected tools for trading, client relations, and marketing, leading to cognitive overload and operational risk.

The Goal: Centralize the entire institutional lifecycle — from lead generation to trade execution — into a high-density, low-friction “Hub.” For past years I contributed to the visual identity, the design system revamp, and the entire multi-module platform to centralize lead generation, client management, and client interactions.

02. The Strategy

I designed a scalable architecture broken into specialized modules, ensuring that as the platform grew, the user experience remained consistent and intuitive.

Performance & Strategy

- My Hub: A situational awareness “Command Center” using card-based UI to prioritize Assets Under Management (AUM), urgent tasks, and market alerts.

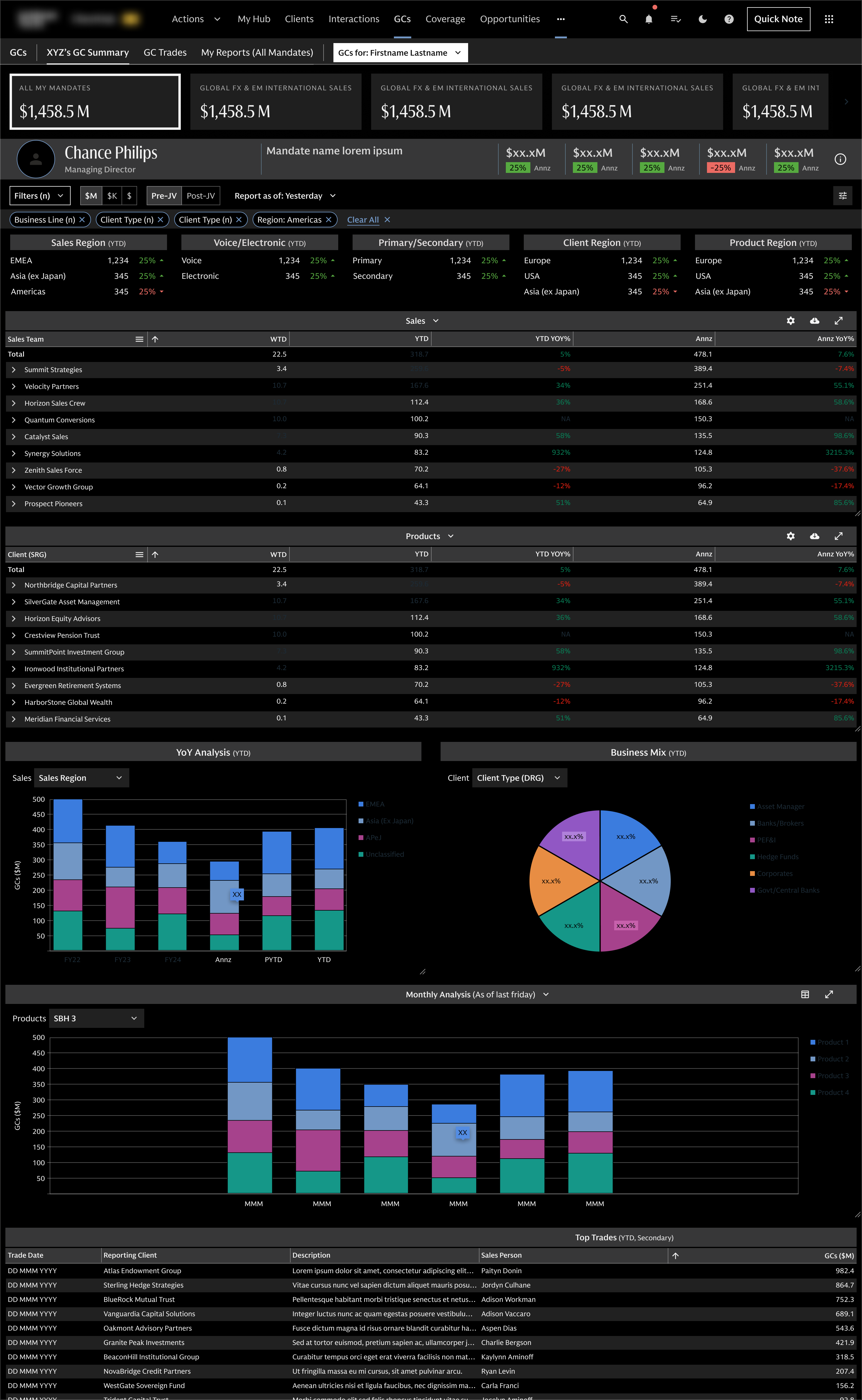

- GCs (Gross Credits): A performance-tracking module for Sales Teams and Individuals. I designed high-density visualizations to show credits earned on trades placed, allowing users to track revenue targets and individual contributions in real time.

Revenue Pipeline & Growth

- Opportunities: A “Pipeline Intelligence” view. I replaced static lists with status-tracked deal cards to visualize liquidity and upcoming revenue stages.

- Campaigns: An outreach module focused on performance tracking, showing how marketing efforts directly convert into portfolio opportunities.

03. Design Principles for High-Density Data

To manage the massive volume of information across 8+ modules, I applied three core UX strategies:

- Progressive Disclosure: Used nested tabs and expandable rows (especially in Trades and Clients) to keep the primary view clean while making deep data available on demand.

- Contextual Navigation: A persistent global sidebar with “Universal Search” allows advisors to jump from a Trade log to a Client Profile in under 2 seconds.

- Visual Trust & Hierarchy: Reserving high-saturation colors for “Action-Required” states (like pending trades or expiring opportunities) to reduce cognitive noise during long-tail usage.

04. Final Impact

- Operational Efficiency: Replaced 4+ legacy tools with a unified interface, projected to reduce advisor context-switching and reporting time by 40%.

- Incentive Clarity: By centralizing the GCs (Gross Credits) module, I provided sales teams with transparent, real-time feedback on their trade performance and earnings.

- Future-Proof Scalability: The modular design system allows the firm to integrate new asset classes or performance metrics without a total UI overhaul.

- Unified Voice: Established a consistent, modern brand authority across the entire institutional platform.