Streamlining Consumer Banking

Mobile Banking · Fintech · User Testing & Accessibility

01. Project Overview

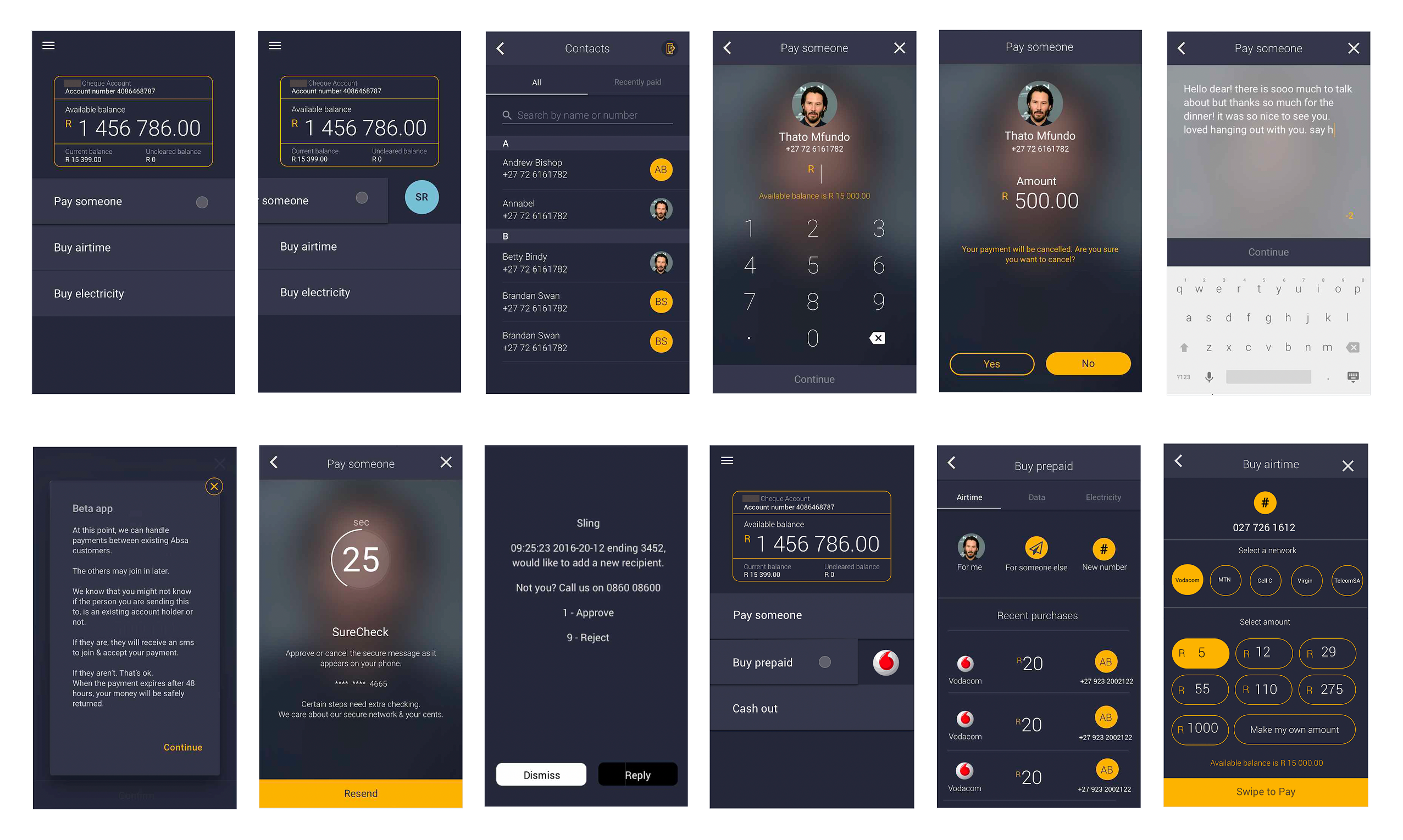

Sling is a mobile banking application designed to simplify daily financial tasks — such as money transfers, airtime/data purchases, and cash-outs — for a diverse consumer base. The project focused on refining the user experience by identifying friction points through rigorous user testing and implementing high-visibility UI improvements.

02. The Challenge: The Friction of Finance

Even simple financial transactions can cause user anxiety if the interface is cluttered or the feedback loops are unclear. Initial testing revealed that users struggled with:

- Discoverability: Difficulty finding key actions like ‘Cash Out’ or ‘Transaction History’

- Clarity: Confusion regarding balance displays versus available funds.

- Confirmation Bias: A lack of satisfying and clear confirmation when completing a high-value action (e.g., sending money).

03. User Testing & Key Findings

I conducted usability audits to observe how users interacted with core features. Key insights included:

- Interactive Elements: Users preferred tactile, gesture-based interactions over traditional buttons for final approvals.

- Visual Hierarchy: Essential data (Account Balance) needed to be the focal point without overwhelming secondary actions.

04. Design Solutions & Feature Highlights

The “Swipe-to-Confirm” Mechanism

To reduce accidental transactions and increase the sense of ‘action completed,’ I implemented a “Swipe to Buy” and “Swipe to Send” interaction. This deliberate gesture provides a psychological safety net for the user before funds are moved.

Optimized Utility Payments

I redesigned the Airtime and Data purchase flow to be a single-screen experience.

- Dynamic Menus: Integrated network provider selection and bundle options into a clean, vertical scroll.

- Smart Filtering: Options like 500MB, 1GB, and 2GB are presented with clear pricing and validity periods to ensure transparency.

Transaction Visibility

The Transaction History was overhauled to emphasize clarity.

- Color-Coded Status: Clear indicators for outgoing vs. incoming funds.

- Detailed Receipts: Each transaction expands to show full metadata (date, reference, and fee breakdown).

05. System Synoptics & Logic

Beyond the consumer-facing UI, the project involved designing the underlying logic for the banking system’s operational states. This included:

- System Diagrams: Mapping out Auto vs. Closed states for backend transfers.

- Failure States: Designing clear, non-alarming error messages for system timeouts or insufficient funds to keep the user informed rather than frustrated.

06. Visual Language

- Modern Minimalism: Used a high-contrast white and blue palette to evoke a sense of professional security and modern tech.

- Typography: Utilized clean, sans-serif fonts to ensure financial figures are legible on small mobile screens even in low-light conditions.

- Accessibility: Focused on button size and touch-target areas to accommodate users with varying degrees of mobile literacy.

07. Results & Impact

- Higher Conversion: The simplified Airtime/Data flow reduced task completion time by an estimated ~25%.

- Error Reduction: The “Swipe to Confirm” feature virtually eliminated reported “accidental” money transfers during the beta phase.

- User Satisfaction: Post-testing surveys indicated a ~80% positive rating for the app’s intuitive navigation compared to traditional banking competitors.